BY USING OUR SITE YOU AGREE TO THE TERMS OF USE AND PRIVACY STATEMENT

AFM is an asset management application based on mathematical principles.

Its objective is to outperform the S&P index

while minimizing risk exposure.

while minimizing risk exposure.

Traditional research and analysis make it practically impossible to consistently beat the stock market index over time.

A DIFFERENT APPROACH WAS REQUIRED.

Instead of pursuing high-potential stocks, AFM employs a data-driven

strategy independent of human intervention.

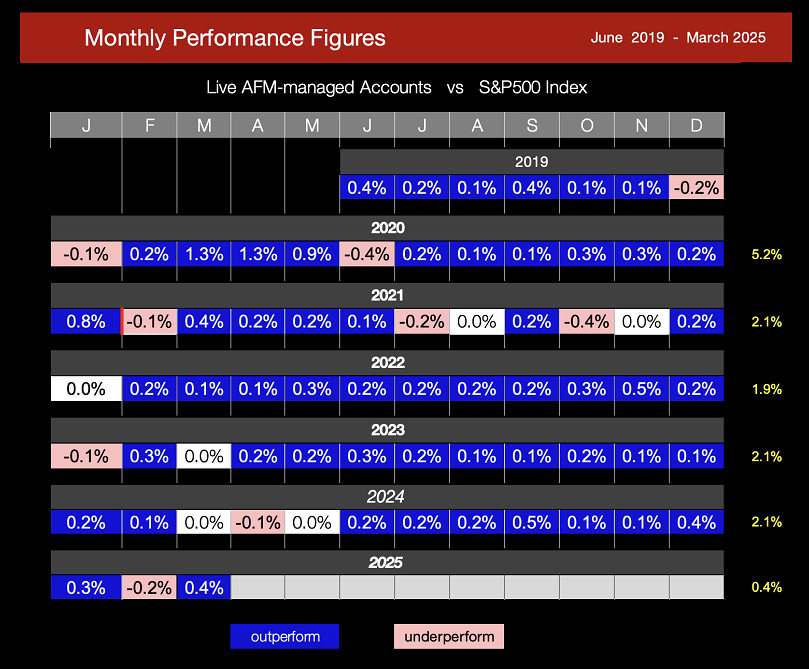

AFM-managed portfolios have outperformed the index by approx. 2.0% every single year since inception 6 years ago.

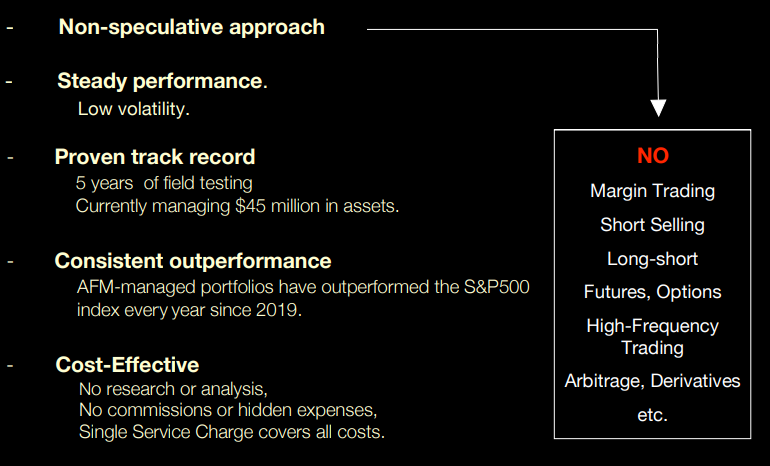

Advantages

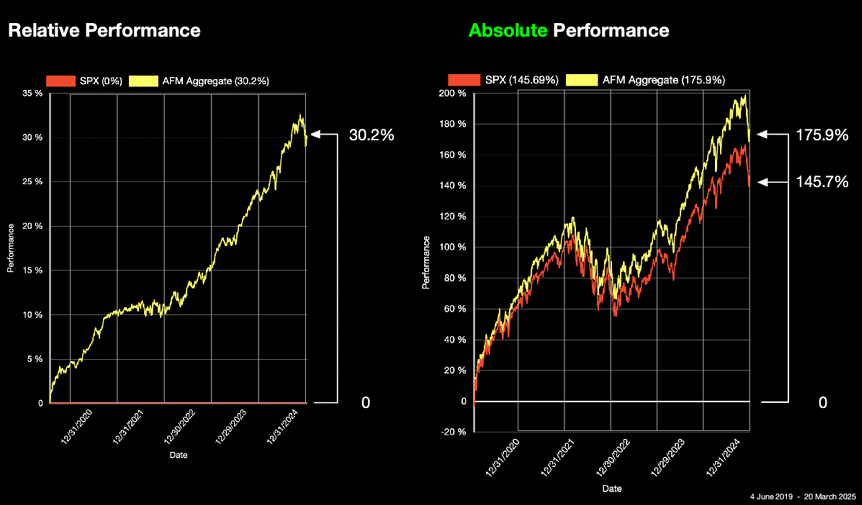

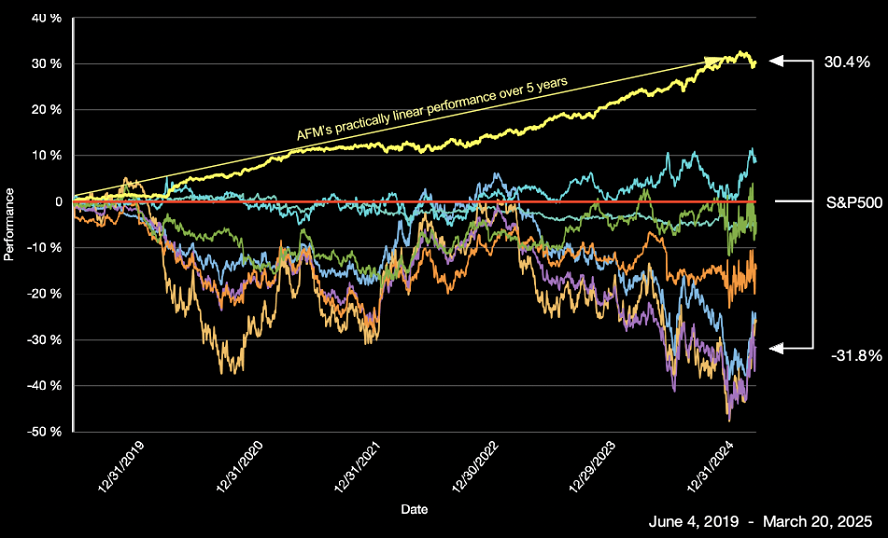

How AFM-managed portfolios stacked up against the S&P500 index over 5 years

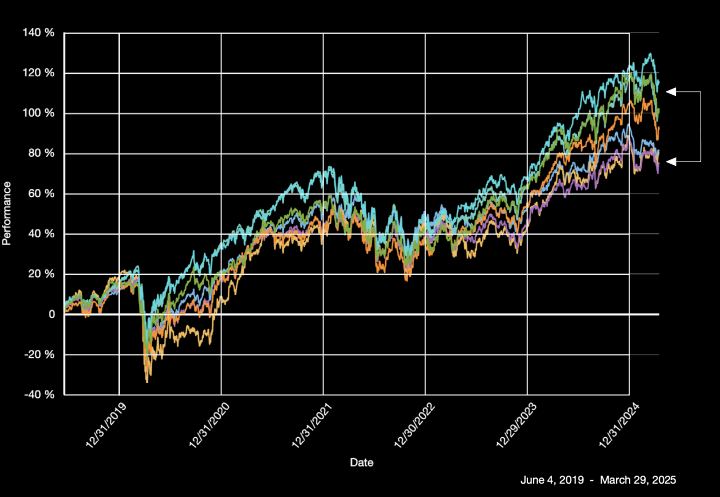

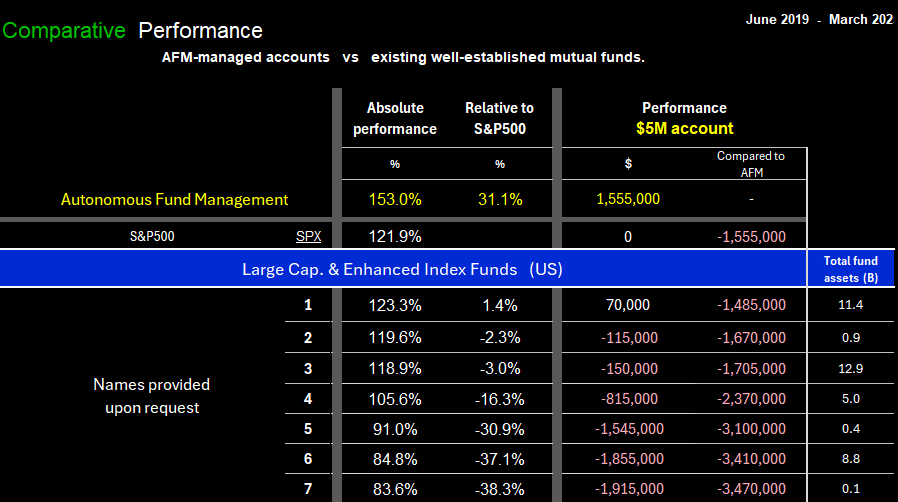

How seven Large Cap US Funds performed over the same period

Absolute performance

Most investors look at the absolute performance of a fund before deciding on an investment.

Between June 2019 and March 2025 most results were encouraging.

Seven major Large-Cap US funds listed below rose between 76.9% and 111.9%.

Between June 2019 and March 2025 most results were encouraging.

Seven major Large-Cap US funds listed below rose between 76.9% and 111.9%.

Seen from a relative point of view, things were somewhat different.

Only one Exchange-traded fund managed to outperform the market, achieving a return of +8.6%.

In stark contrast, AFM-managed accounts significantly outperformed with a return of +30.4%.

All other funds experienced losses.

AFM's pratically linear performance is ensured by procedures which cover the entire S&P500 index.

A task too labor-intensive for traditionally managed funds.

A task too labor-intensive for traditionally managed funds.

AFM-managed accounts significantly outperformed selected large-cap US mutual funds over 5 years.

Further attributes

Direct account management

- Operates directly within the investor’s account.

- No transfer of funds required.

- Procedure can be stopped at any time by the user himself.

- AFM is authorized to buy and sell securities not to transfer funds.

Broad diversification

- Includes data from the entire S&P 500 index, resulting in a practically linear performance and making it one of the most stable investments available.

Data-driven startegy

- Relies solely on data input.

- Automation minimizes the risk of human error.

AFM-managed accounts rarely underperform the S&P500 index.

Performance figures depend on the base used for their calculation. Annual performance figures are not the sum of 12 monthly figures, etc.

Assets under AFM-management (until Nov. 2024)

AFM concept, source code, websites and layout are privately-owned and subject to intellectual property rights.

Contact us by calling +41 (0)78 796 81 83 or via online form