BY USING OUR SITE YOU AGREE TO THE TERMS OF USE AND PRIVACY STATEMENT

AFM is an asset management application based on mathematical principles.

Its objective is to outperform the S&P index

while minimizing risk exposure.

while minimizing risk exposure.

scroll down

to learn more

to learn more

Traditional research and analysis make it practically impossible to consistently beat the stock market index over time.

A DIFFERENT APPROACH WAS REQUIRED.

Instead of pursuing high-potential stocks, AFM employs a data-driven

strategy independent of human intervention.

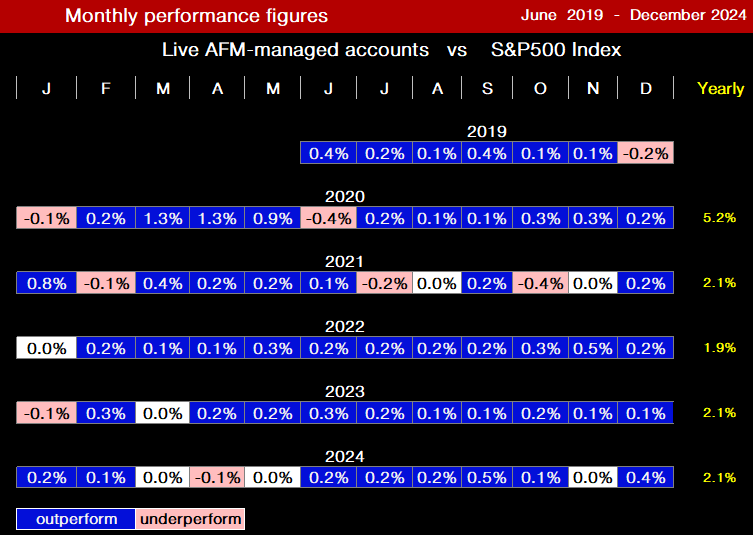

Managed portfolios have outperformed the index by approx. 2.0% every single year since inception 6 years ago.

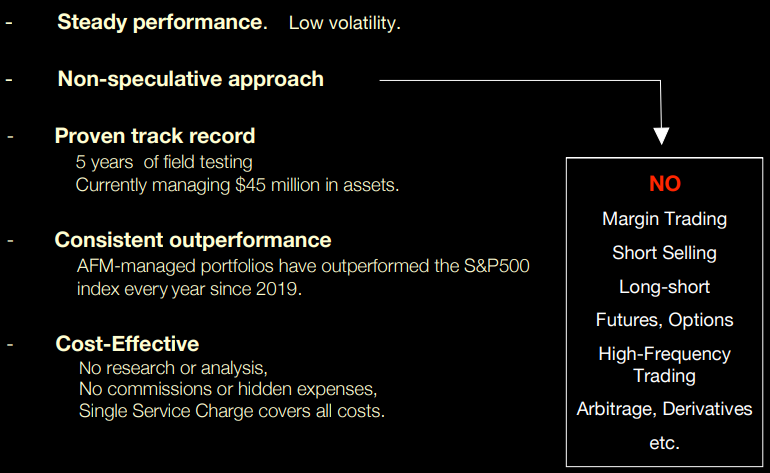

Advantages

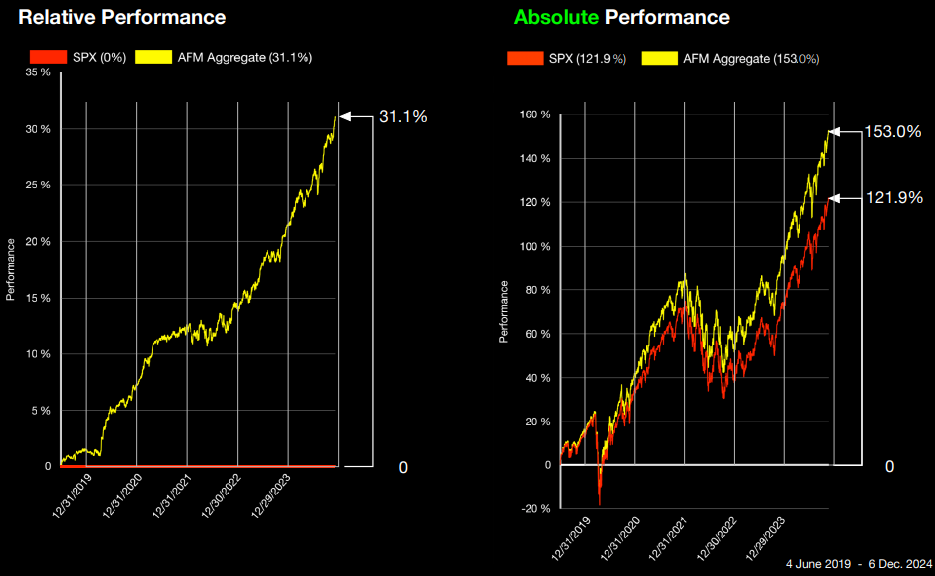

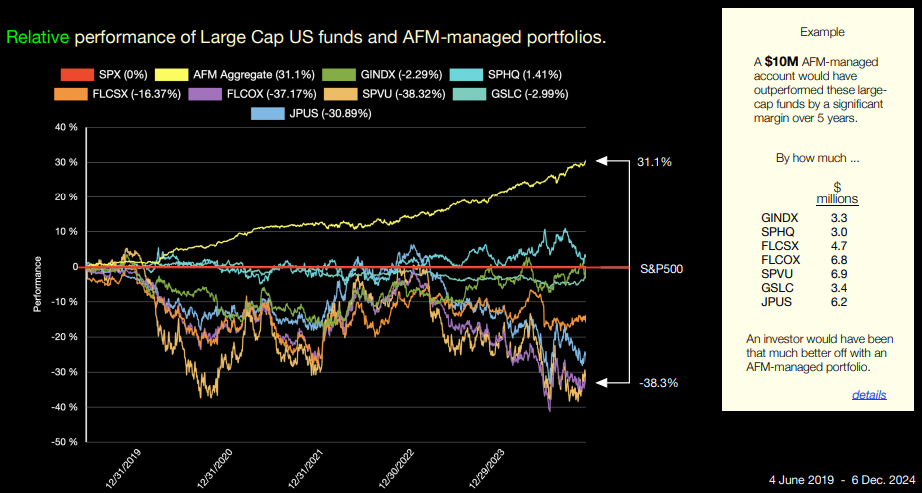

How AFM-managed portfolios stacked up against the S&P500 index over 5 years

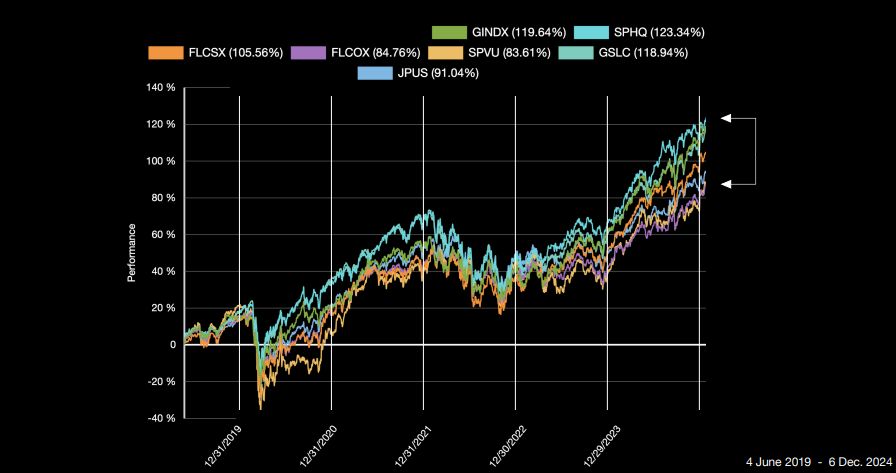

How seven Large Cap US Funds performed over the same period

Absolute performance

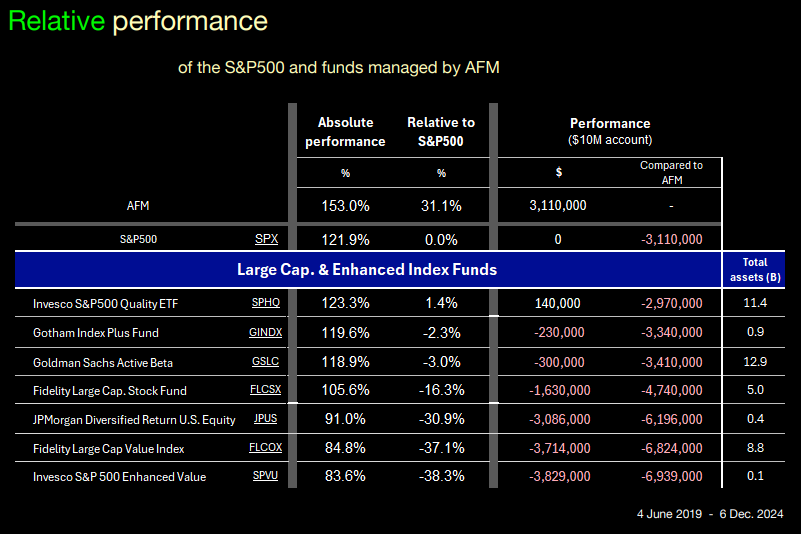

Most investors look at the absolute performance of a fund before deciding on an investment.

Between June 2019 and December 2024 results were encouraging.

The 7 Large-Cap US funds listed below rose between 83.6% and 123.3%.

Between June 2019 and December 2024 results were encouraging.

The 7 Large-Cap US funds listed below rose between 83.6% and 123.3%.

Seen from a relative point of view, things are somewhat different.

Only SPHQ (Invesco S&P 500 Quality ETF) managed to outperform the market, achieving a return of +1.41%.

In contrast, AFM-managed accounts significantly outperformed with a return of +31.1%. All other accounts were in the red.

Note AFM’s consistency, practically a straight line.

Such performance can only be achieved by using machine-driven procedures.

Such performance can only be achieved by using machine-driven procedures.

Further attributes

Direct Account Management

- Operates directly within the investor’s account

- No transfer of funds required

- AFM is granted trading rights, not fund transfer rights.

Broad Diversification

- Includes a wide range of S&P500 companies to ensure stable performance.

Data-Driven Strategy

- Relies solely on data input.

Reduced Human Error

- Automation minimizes the risk of human error.

AFM managed accounts rarely underperform the S&P500 index.

Performance figures depend on the base used for their calculation. Annual performance figures are not the sum of 12 monthly figures, etc.

Assets under AFM management (until Nov. 2024)

AFM concept, source code, websites and layout are privately-owned and subject to intellectual property rights.

Contact us by calling +41 (0)78 796 81 83 or via online form